India Vix Meaning

Want to know India Vix meaning? India Vix is simply a volatility index but let us dive deep into the meaning of it. You might have noticed that the key indexes such as Nifty 50 and Banknifty become volatile that is they fluctuate a lot during major events like elections. You can say it is kind of telling us how uncertain and how much confusion is there in the market. When there are major events related to the market, people usually have no confirmation of what is gonna happen which is what India VIX tells us. It gives an overview of how up and down the market can go in the next 30 days. If you are an options trader, you will come across this Index a lot and so it is important to know how this index actually works. In this article we will also reveal 5 key insights that you can use to make better investment and trading decisions. Understanding India VIX is not only crucial for traders but also investors.

1. What is India VIX?

India India VIX meaning is nothing but a fear index. Yes, you heard it right it is a fear Index because it reflects the expectations of different traders and investors in the stock market. For example there is no clear view of where the market will go. Some are thinking that the market will go up, some are thinking that the market will go down, some are thinking the market will remain stable but no one knows exactly where the market will end up and there is no clear point of every investor. India VIX increases a lot during elections for example during the 2024 elections. There were so many twists involved, one day the market shot up but the next day with a twist it went totally down due to the fear involved of who is gonna win and with how many seats. This Index is calculated based on the order book of Nifty and gives an overview of the next 30 days of the volatility in the market. Understanding this index may help you anticipate the market movements. This is important if you want to manage risk more effectively.

The image next shows the extreme twists in India VIX during elections. Just check how the index shot up and down during the exit poll results.

2. Indicator of Market Sentiment

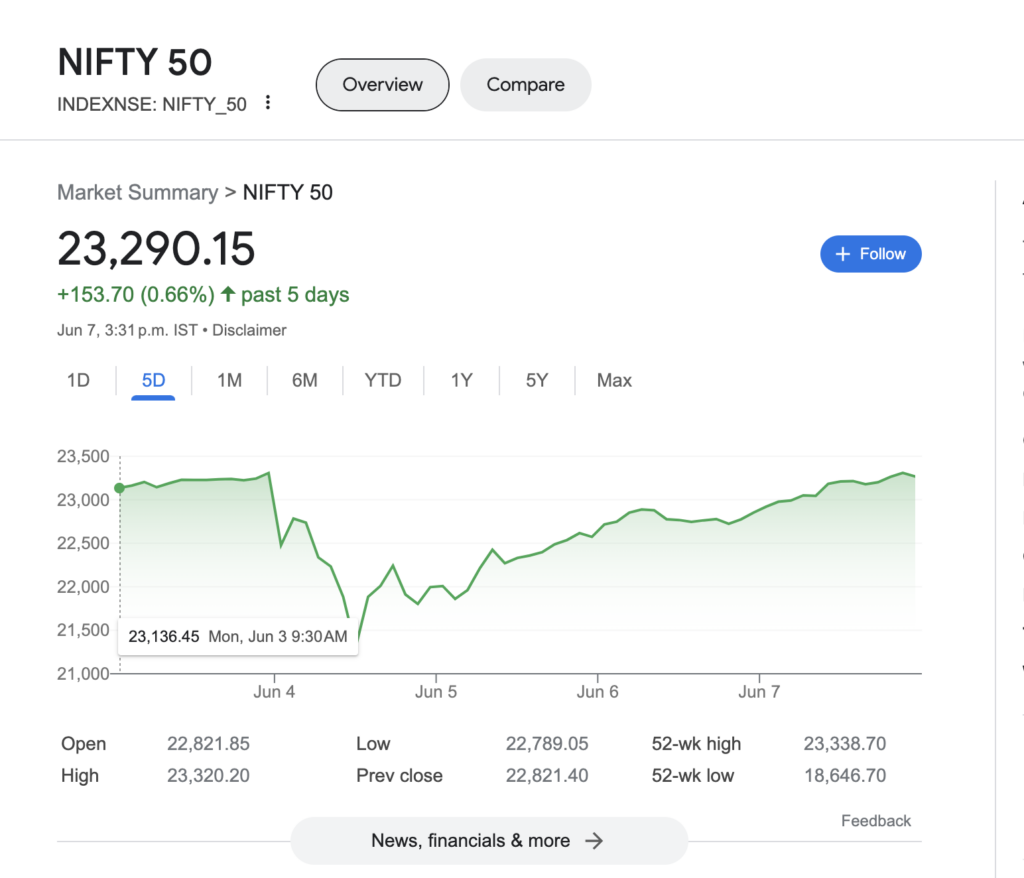

Go open the graphs of both Nifty 50, Banknifty together with the chart of Nifty VIX. You will notice that when the index is high, the ups and downs in the market that is the fluctuations are a lot higher whereas when the index is low, the ups and downs are also quite low are the market is more stable. This shows how uncertain the investors are in the market and are risk-averse. Tracking this index helps investors determine when it is the right time to invest and helps traders determine when to trade and when not to depending on their risks and what strategy to use. Many traders like to lower their risks during high volatility by implementing hedges.

The below image shows how the market reacted inversely to India VIX during exit poll results.

3. Risk Management Tool

India Vix is a great tool when it comes to risk management. Some traders like to lower their risk by using low risk strategies like Short iron condor when the volatility is high. This strategy involves the use of hedges. Tools like Sensibull and Quantsapp are great strategy builders for this. You can easily build your strategies and analyse the risk involved in a few clicks using strategy builders. A high volatility index might signal the traders that it is time to hedge and reduce the risk to volatile assets. When India Vix is reducing, it is usually a good time for investors as it indicates the positive sentiment and mood of the market. India VIX meaning is a synonym for some investors when it comes to risk management.

Below is the image of a strategy builder used for analysing risks and using the strategy accordingly.

4. Strategic Investment Decisions

This article on India VIX meaning cannot be complete without talking about the strategic investment decisions. The insights given by this indicator helps in making strategic trading and investment decisions. The investors and traders can decide the strategies to use according to high and low India VIX as indicated previously. India VIX tells the right opportunities to enter the market.

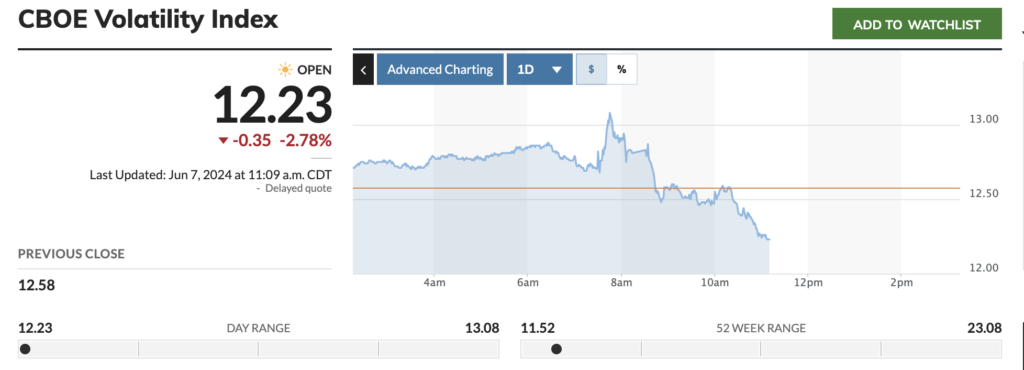

5. Comparative Analysis with Global Volatility Indexes

India VIX does not operate alone. You will notice that some of the global events also impact this index. Keep an eye on the CBOE VIX for this as a lot of events of the global market are reflected in the Indian market.

Conclusion

India VIX meaning is crucial for anyone involved in trading and investing in the Indian stock market. It not only helps in analysing the current market conditions but also helps predicting the future market movements. By using this index, you can make strategic and informed trading decisions leading to better investment and trading outcomes.

Filing Taxes? Try our GST Calculator