OI Pulse Review

Technical analysis is not the only factor one should use when it comes to trading. Having access to accurate and most updated data is important to make informed and good trading decisions. OI Pulse is a tool modern traders use for analysing the market and enhancing their trades. In this article we will dive deep into the review of OI Pulse and how it can help you enhance your trades and make better trading decisions.

What is OI Pulse?

The first and the foremost question is what OI Pulse really is? OI Pulse is a tool which is used for continuous monitoring and analysis of Open Interest in the Futures and Options (That is Derivatives) market. Now the question is what is Open interest? Open interest tells us the total number of outstanding contracts in Futures and Options that have not been settled yet. How is it different from volume? Volume measures the number of contracts traded within a specific period while open interest tells us the total number of unsettled contacts in the market. Modern traders have combined this data to enhance their trading decisions.

The Importance of Open Interest

Anyone trading in derivatives should be aware of Open Interest due to its importance

- Market Sentiment: Open Interest helps in analysing the market sentiment. If the open interest increases along with a rise in price, it indicates a bullish market as more traders are entering the market with a long position while an increase in Open Interest along with a decrease in price indicates a bearish market.

- Liquidity Measurement: You might have noticed that if you set a stop loss with a lot of quantity, the order does not get executed sometimes for all of the quantity. Have you wondered why? Because there is not much liquidity. Higher open interest indicates that there are more participants and this leads to a much better liquidity. This ensures that traders can enter and exit the market position much more easily.

- Trend Confirmation: Traders can analyse the trend of the market and make positions accordingly by analysing Open Interest. Open Interest gives a confrimation of the trend.

Features of OI Pulse

When writing this OI Pulse review, we were amazed by the great features it has which are beneficial for both option buyers as well as option sellers.

Below are some of its key features

1. Real-Time Data

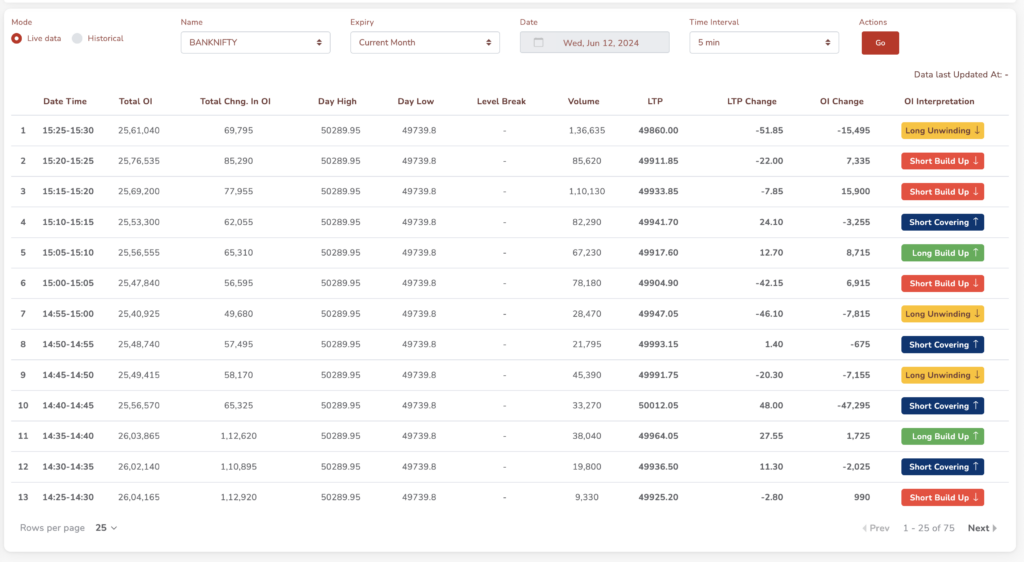

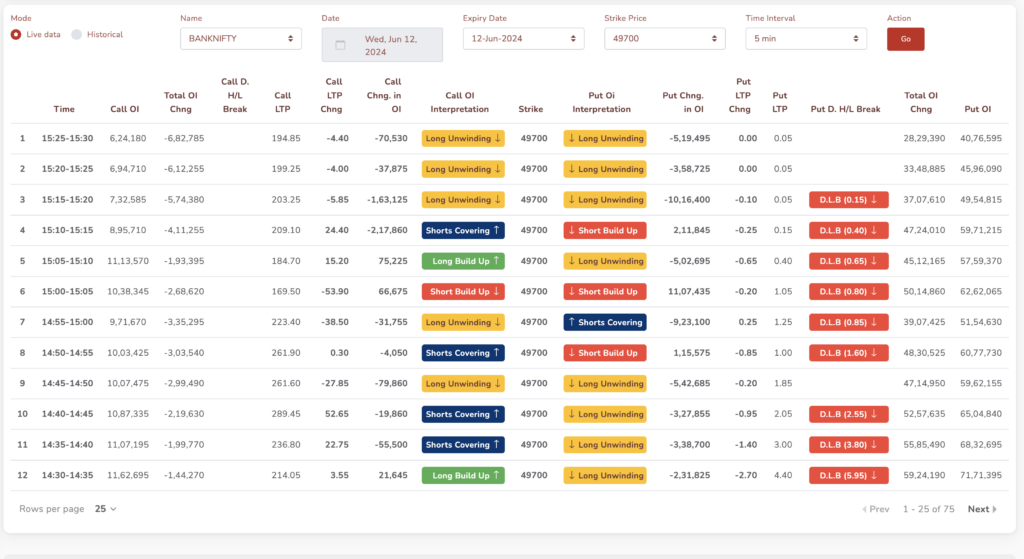

With OI Pulse, you can get live insights of the market. Simply use the OI analysis tool which shows a detailed overview of open interest for every strike price that is the Call Open Interest, Put Open Interest, the change in Open Interest and the total change. This is a great feature to analyse the trend of the market.

2. Historical Data Analysis

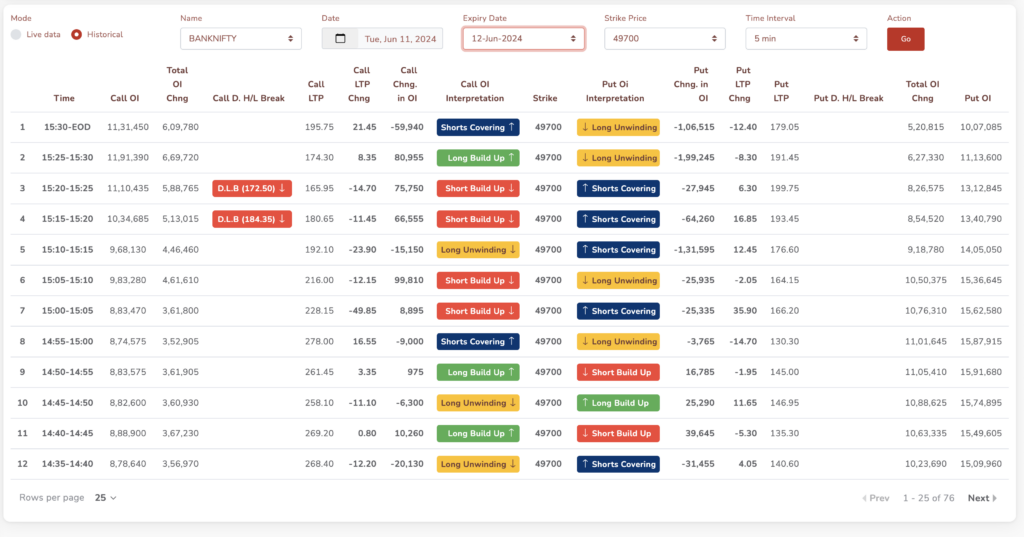

Similar to live data, OI Pulse gives you an opportunity to analyse the historical data. Traders can review the past open interest patterns to identify the trend of the market. This is a great backtesting strategy.

3. Custom Alerts

OI Pulse allows traders to set custom alerts based on specific open interest criteria.

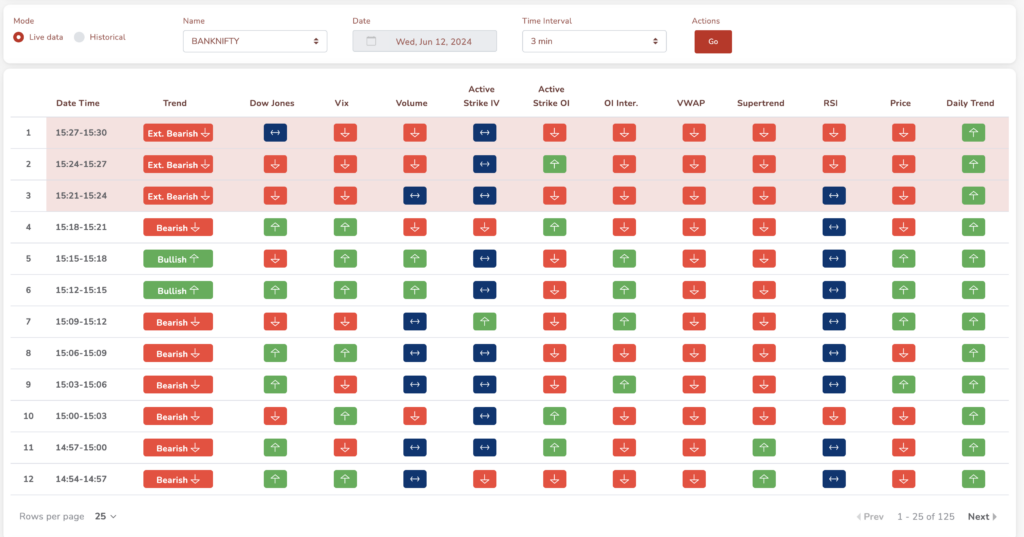

4. Comprehensive Reporting with connecting dots

Connecting dots feature of OI Pulse gives a combined insight of literally every important data you will need to figure out the trend of the market. OI Pulse review cannot be complete without mentioning about this great feature.

5. Integration with Trading Platforms

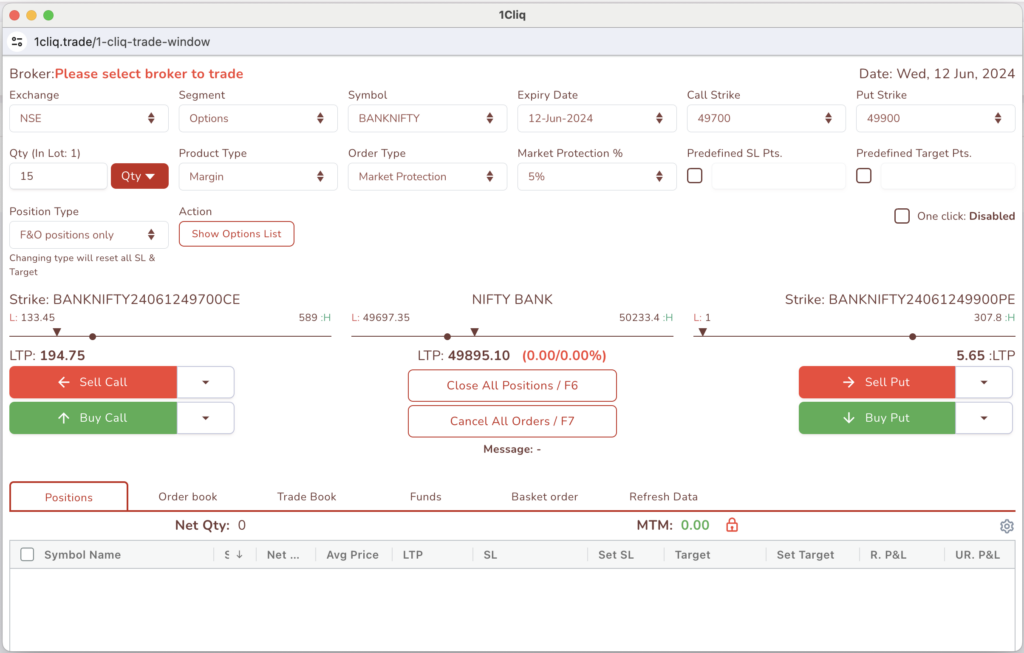

OI Pulse can be integrated with your broker to reduce the delays in your trades. With its 1cliq features you can just press a keyboard key to execute your trade at the right time with minimal delay.

How to Use OI Pulse in Trading

OI Pulse can be a powerful tool for traders when used correctly. Here are some strategies to effectively incorporate OI Pulse into your trading:

1. Identifying Trend Reversals

OI Pulse offers great features for identifying trend reversals. By using its open interest analysis and connecting dots, one can easily identify if there is a trend reversal.

2. Confirming Breakouts

Open Interest is a great tool for identifying breakouts by checking the spikes in open interest. This can also be used to identify false breakouts.

3. Understanding Market Sentiment

Analysing the ratio of call and put option, one can have a much better understanding of the market sentiment. This is a feature OI Pulse is made for.

Case Study: Using OI Pulse in Options Trading

Let us take an example of a case study to understand how OI Pulse can be used to enhance your trades. Imagine that there is a stock that has been bearish for quite a while. You will notice that the open interest in call option is far greater than that in put option. This indicates a bearish market. But suddenly the open interest in put option starts to increase and the price of the stock starts to increase. This shift suggests that traders are anticipating a trend reversal and modifying the position accordingly.

Conclusion

OI Pulse is an invaluable tool for option traders to analyse the market and make positions accordingly. It offers great features for identifying the trend, backtesting strategies. Using OI Pulse, you can get deeper insights of the market. The features of the OI Pulse far outweigh its price. There are so many invaluable features offered that they cannot even be covered in this OI Pulse review and we recommend checking out their Youtube tutorial videos for this purpose. By analysing the market with OI Pulse, traders can make better informed decisions.

The trend of the market keeps on changing and for being a successful trader, it is important to be well informed about the latest data available. Backtesting historical data and live data insights can help you enhance your trading journey.

Liked our review? Why not give OI Pulse a try?

Filing taxes? Checkout our GST Calculator!